National Debt $36.1T

Interest per day $3B (more than $1/2T/year

2025-2025 deficit spending= approx$3T over 10 years

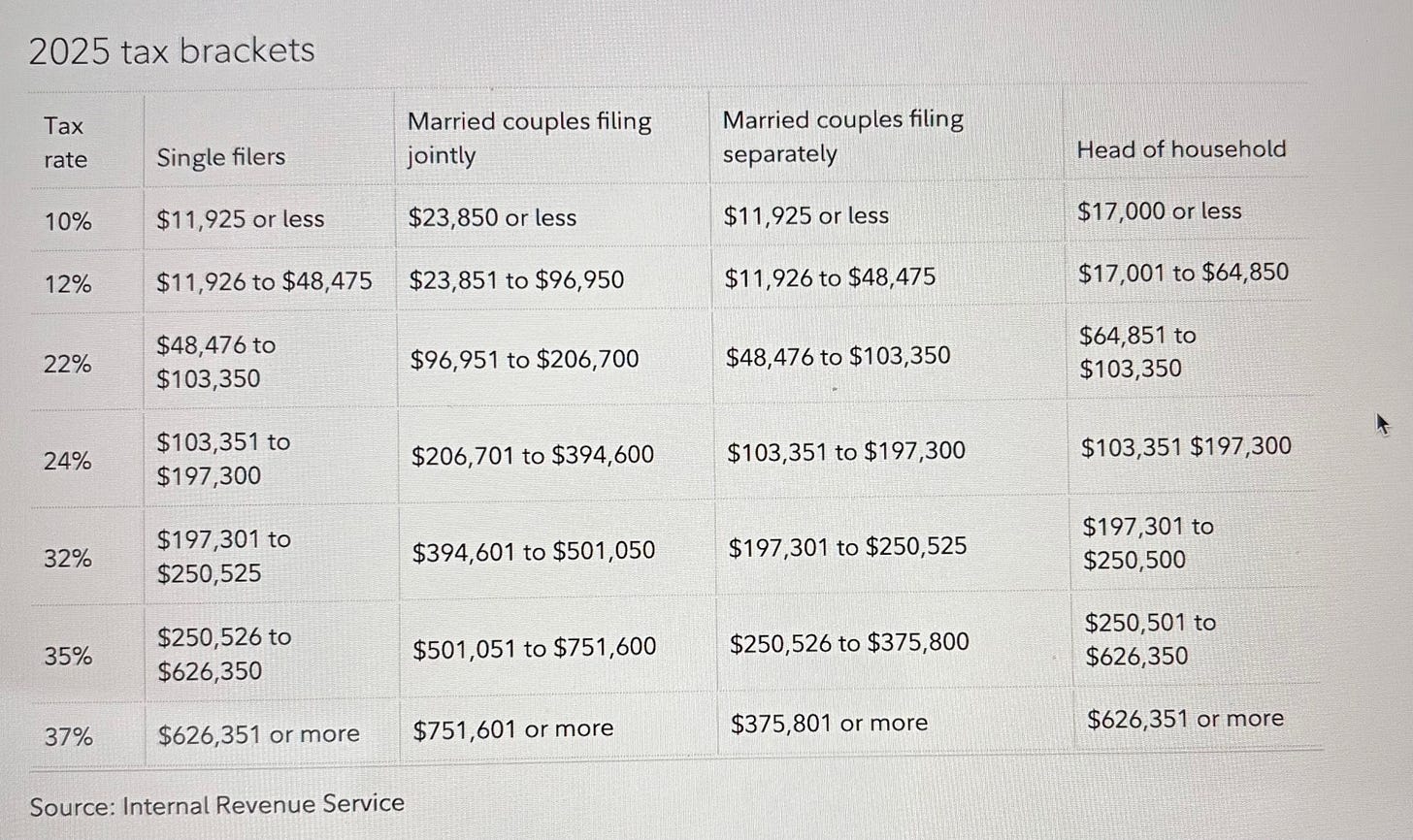

Tax brackets

Corporate tax rate= 21%

Current interest: The current Fed rate is 4.25% to 4.50%.

Household income= In the US, household income distribution shows a wide range, with the top 10% earning significantly more than the bottom 10%. In 2023, the median household income was $77,700. While 38.9% of households made over $100,000, 32.3% made less than $50,000. The wealthiest households (top 3.65%) earned 17.5% of all income, while the bottom 10.3% earned only 1.06%.

Spending in the federal budget is grouped into categories, which are known as budget functions. Each function comprises a group of activities or programs that share a similar public purpose, making it easier to compare and analyze overall spending priorities. The 10 largest budget functions for 2023 are listed below.

Social Security ($1,354 billion). The Social Security function includes the two programs administered by the Social Security Administration: Old Age and Survivors Insurance and Disability Insurance. This function includes both benefit payments to retired and disabled workers (and their spouses, survivors, and dependent children) as well as the cost of administering the programs.

Health ($889 billion). The Health function includes most direct healthcare services funded by the federal government (other than Medicare); health benefits for federal employees and certain retirees; and the treatment, assessment, and prevention of health-related issues in the United States. Examples include Medicaid, the Children’s Health Insurance Program, and activities carried out by agencies such as the National Institutes of Health, Centers for Disease Control and Prevention, and Food and Drug Administration.

Medicare ($848 billion). The Medicare function consists entirely of the Medicare program, which provides health insurance to Americans 65 or over and people with disabilities. Most of the spending goes toward the provision of medical services and prescription drugs.

National Defense ($820 billion). The National Defense function covers the military activities of the Department of Defense. In addition, some funding in this function goes toward the defense-related activities of other departments, such as Department of Energy nuclear programs and the Federal Bureau of Investigation.

Income Security ($775 billion). The Income Security function includes programs that provide cash and other government assistance to individuals in need, such as those who are unemployed or earning a low income. Examples include unemployment compensation, the Supplemental Nutrition Assistance Program, Supplemental Security Income, Temporary Assistance for Needy Families, certain federal retirement programs (other than Social Security), and housing assistance. In addition, refundable tax credits (payments that exceed taxes owed) fall into this budget function.

Net Interest ($658 billion). The Net Interest function includes interest payments on the federal debt paid to private holders of U.S. Treasury securities. It is partially offset by interest income on loans as well as earnings from the National Railroad Retirement Investment Trust.

Veterans Benefits and Services ($302 billion). The Veterans Benefits and Services function includes the spending of the Department of Veterans Affairs and affiliated programs. Most of the spending in this function is for veterans’ compensation, pensions, and health care.Transportation ($126 billion). The Transportation function includes spending on highways, public transit, the Transportation Security Administration, the Federal Aviation Administration, the Federal Railroad Administration, and most programs of the Coast Guard.Commerce and Housing Credit ($101 billion). The Commerce and Housing Credit function includes programs that support commercial activities, including housing credits, interest payments on the Postal Service, deposit insurance, and several other miscellaneous programs.Community and Regional Development ($87 billion). Community and Regional Development supports both facilities and financial infrastructure. It includes grants and programs to encourage urban development, grants to develop depressed areas, and disaster relief and insurance in communities that are recovering from natural disasters.

Source: Office of Management and Budget, Historical Tables, Budget of the United States Government: Fiscal Year 2025, March 2024.

Health care costs in the G7 countries (not including the US) are $6,500/person/year

Health care costs in the US are double at $13,000/person/year

Why are we double the rest of the world?

There are a lot of things we can do besides cutting taxes and increasing the deficit in the Big Beautiful Bill. Times are good, this is the time to be putting money away for the rainy day. Social Security, Medicare, Medicaid, and Defense Spending can’t be sacred cows. I suggest:

Double the medicare tax

Increase the retirement age gradually over the next 10 years to 70

Get healthcare costs in line with the rest of the G7 (there’s a 50% opportunity right there)

Decrease Defense spending

Increase the cap on payroll tax from $176,00 to no limit

Make the first pass at reducing the debt with a budget surplus

Increase taxes, just do it

Increase the Medicare premium for the top 50%

Increase corporate taxes

Take a very hard look at cuts in the income security budget line

Increase spending in IRS auditing

All the best

Bruce